HOW IT WORKS

Applies to one-time purchases only.

Checkout As Guest

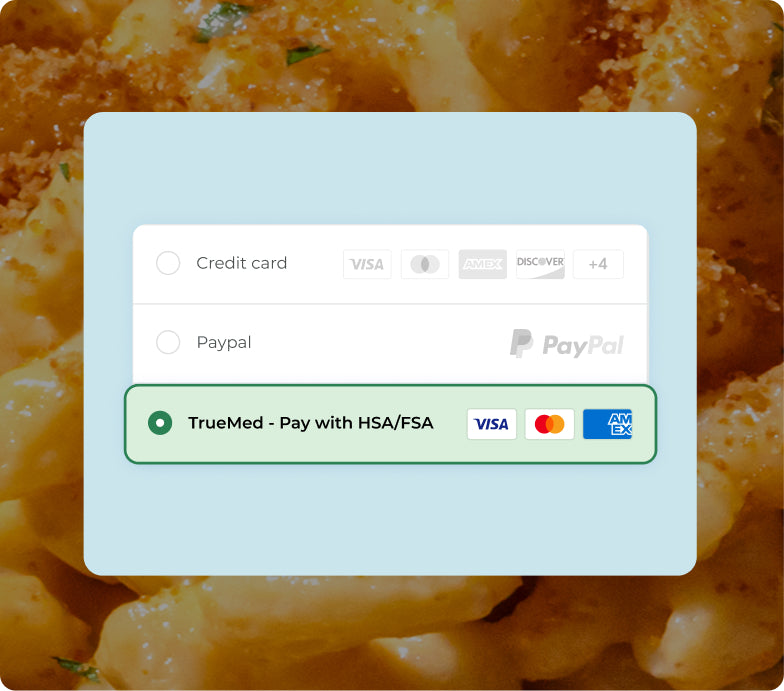

Add your product(s) to cart and proceed to checkout as a guest (not Shop Pay or Express Pay). Select Truemed – Pay with HSA/FSA at payment.

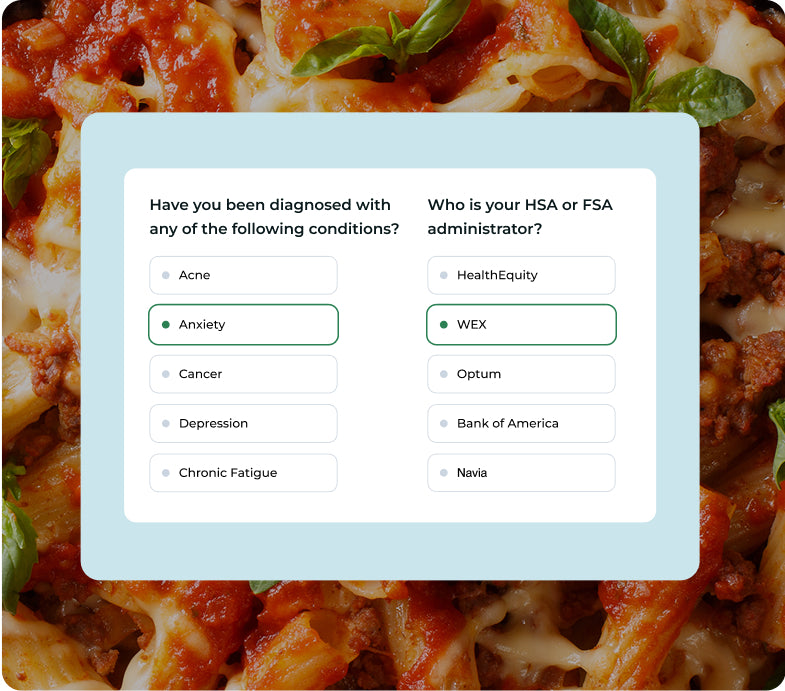

Complete Health Assessment

Fill out a short health survey. A licensed provider will review your answers to confirm eligibility.

Make Your Purchase

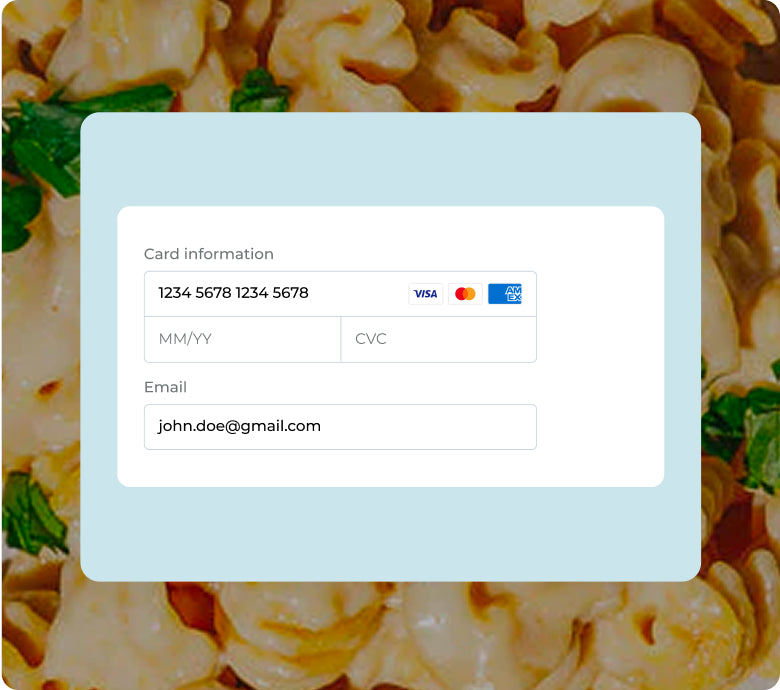

Enter your HSA/FSA card details to complete checkout. If you pay with a regular credit card, you’ll get a guide with your LMN to submit for reimbursement.

SHOP WITH YOUR HSA/FSA FUNDS

SHOP WITH YOUR HSA/ FSA FUNDS

FAQ

-

Health savings accounts (HSA) and flexible spending accounts (FSA) are programs that allow you to set aside pre-tax dollars for eligible healthcare expenses. If you’re unsure whether or not you have an HSA or FSA account, please check with your employer or insurance company.

-

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health. An individual can contribute up to $4,150 pretax to their HSA per year, or $8,300 for a family (plus an additional $1,000 if you are at least 55 years old. Individuals can contribute up to $3,200 pretax to their FSA per year (with an additional $500 in employer contributions allowed).

-

Unfortunately, Truemed’s services are for individuals who have HSA or FSA accounts (or plan to fund one during open enrollment). We encourage you to ask your employer about information on your HSA or FSA!